This tracker monitors the cost of popular building materials, showing how prices are rising, falling, or stabilising over time. We’ve standardised figures on a per m² or m³ basis, using averages to highlight general trends across the market.

As our dataset continues to grow, long-term monthly and yearly trends are becoming more visible. Whether you’re actively pricing a project or keeping an eye on the market, we hope you find this a valuable resource.

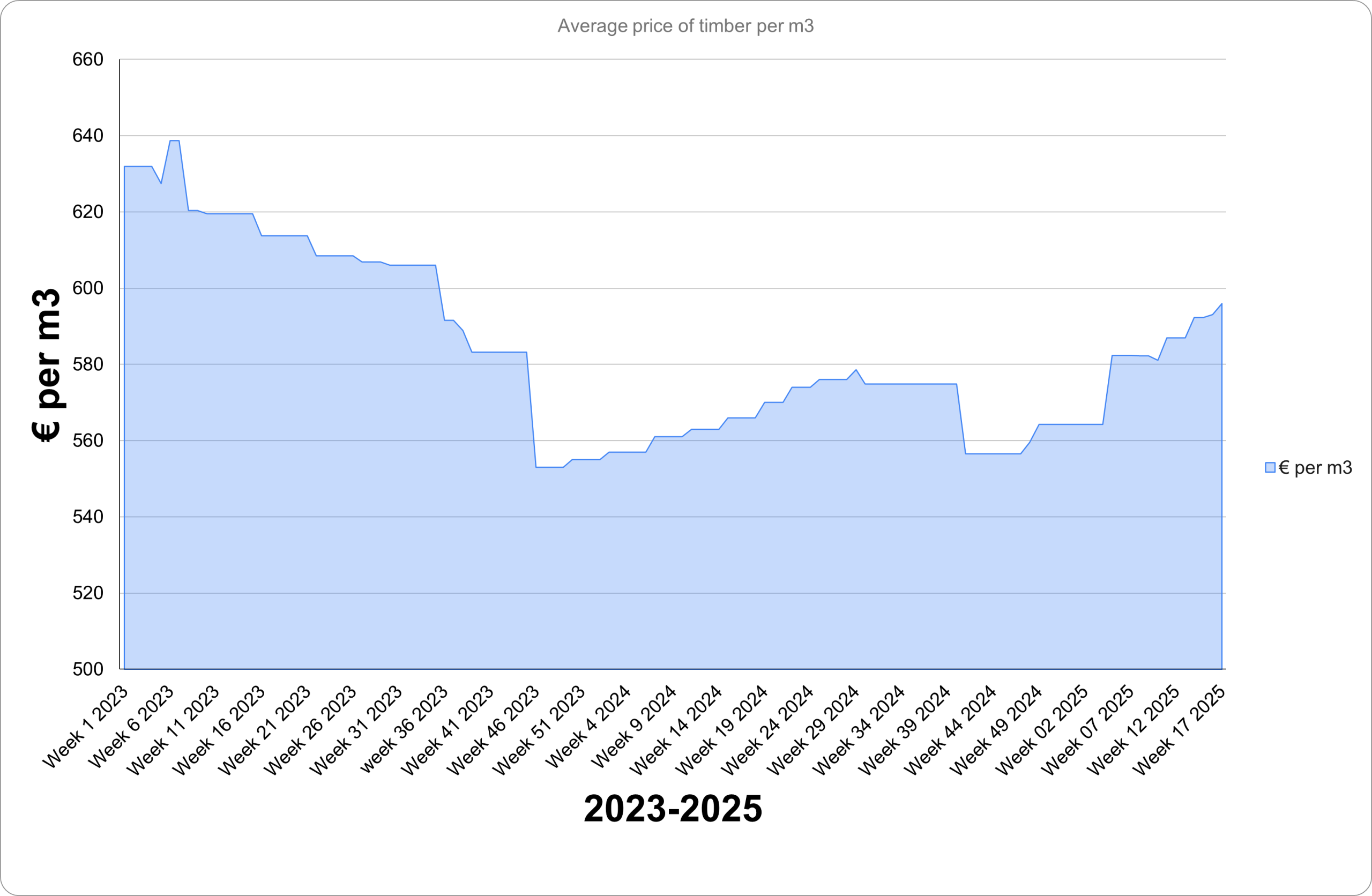

Cost of timber in Ireland

Based on the historical data for timber prices per m³ from 2023 to early 2025, we can forecast the price evolution for the remainder of 2025 by examining the trends and underlying patterns.

Price trend overview:

Timber prices have generally remained stable from 2023 through early 2025, with some notable fluctuations occurring toward the end of 2024 and into early 2025.

In 2023, prices started high at €631.93 per m³ in Week 1 and gradually declined throughout the year. By mid-year, prices had dropped to between €613.74 and €605.98. A more significant decrease occurred in the final quarter, reaching a low of €553.03 in November, before stabilising at €555 by year-end.

In 2024, prices began the year consistently around €555–€557 per m³, rising to €570 in May and peaking at €578.64 in late July. This was followed by a dip to €556.53 in October before rebounding slightly to €564.25 per m³ by year-end.

In early 2025, prices held steady at €564.25 through January. From February onward, prices began to rise, surpassing €582 and reaching €595.99 per m³ by Week 17, signalling a clear upward shift compared to the previous quarter.

Short-term forecast (Q2–Q3 2025):

Timber prices are expected to continue their moderate upward trend through the second and third quarters of 2025. Prices may range between €595 and €600 per m³, supported by seasonal demand and typical supply adjustments. Absent significant disruptions, price movements are likely to be gradual.

Any important developments?

Recent data shows that timber prices have recovered from the late-2024 lows and are now at their highest level since early 2023. The sustained upward movement could influence procurement and budgeting plans in the second half of the year. Key factors to watch include energy costs, raw material availability, and construction sector demand.

-

Shop options This product has multiple variants. The options may be chosen on the product page

Planed Timber

Price range: €1.65 through €28.56 (Inc. VAT) -

Shop options This product has multiple variants. The options may be chosen on the product page

Square Fence Posts

Price range: €8.87 through €21.87 (Inc. VAT) -

Shop options This product has multiple variants. The options may be chosen on the product page

Rough Sawn Timber (C16 grade)

Price range: €1.58 through €63.22 (Inc. VAT)

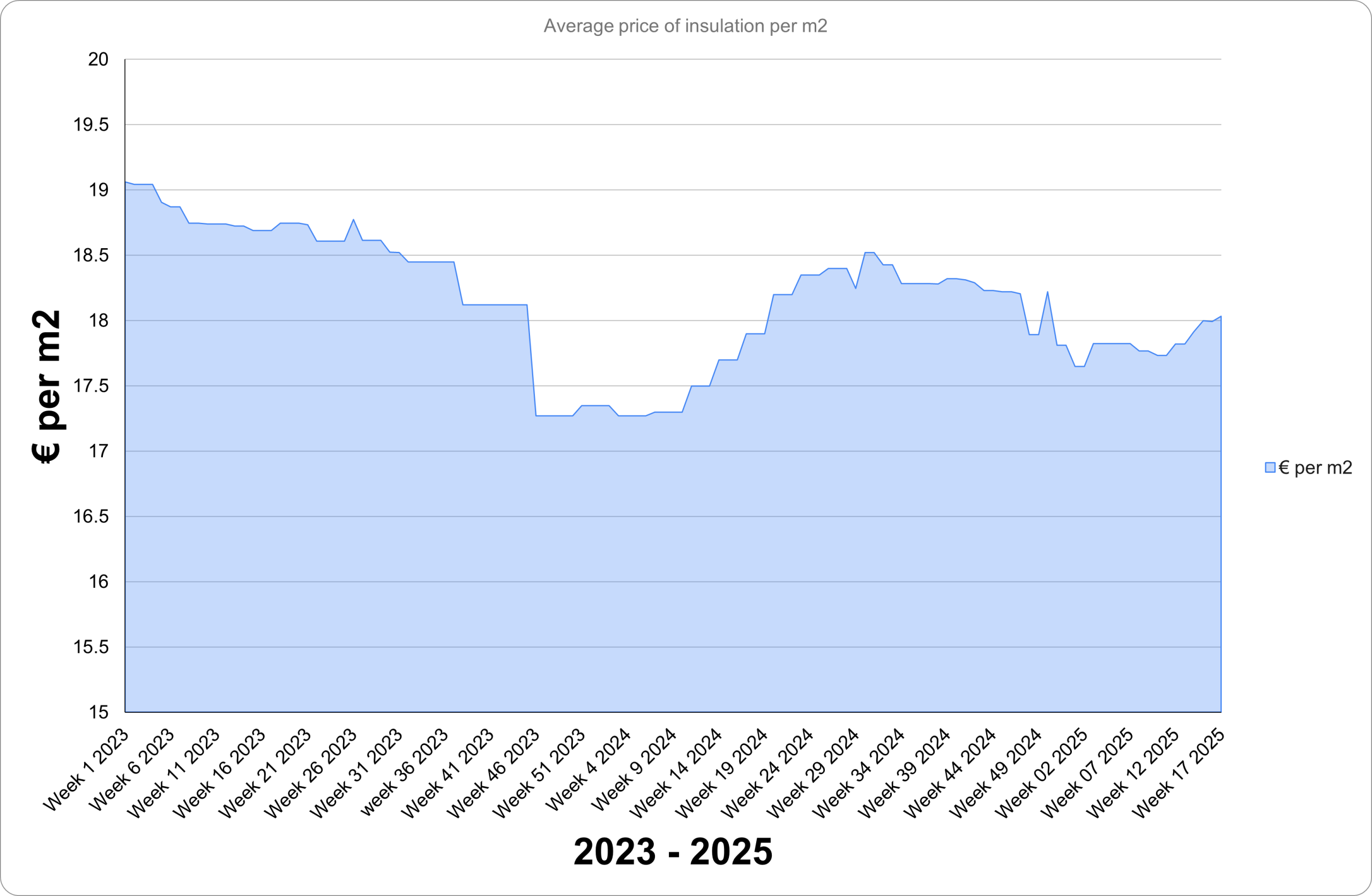

Cost of insulation in Ireland

Based on the historical data for insulation prices per m² from 2023 to mid-April 2025, we can forecast price movements for the remainder of Q2 2025 by examining prevailing trends and key patterns.

Price trend overview

Insulation prices exhibited a gradual decline throughout 2023, starting from approximately €19.06 per m² in January and falling steadily to €17.27 per m² by November. This decline marked the sharpest drop during the year.

In 2024, prices initially stabilised, fluctuating within a narrow range between €17.27 and €18.35 per m². A modest upward movement was seen mid-year, peaking at €18.52 in late July before easing again in the final quarter.

Early 2025 saw a continuation of this pattern. Prices started at €17.65 per m² and climbed gradually to €18.03 by April, indicating a mild upward trend, though still within a relatively stable band.

Short-term forecast (Q2 2025)

Insulation prices are expected to continue exhibiting slight increases over the coming weeks, with values likely to range between €17.80 and €18.10 per m². Barring unforeseen disruptions, the market is expected to maintain overall stability, with gradual movements shaped by energy costs and production dynamics.

Any important developments?

The price trajectory suggests mild inflationary pressure in Q2, with potential for further increases in the second half of 2025. Key influencing factors will include energy prices, transportation costs, and any government incentives related to energy efficiency upgrades. Market participants should continue monitoring input costs and policy developments, particularly regarding retrofitting and sustainability incentives, which may drive demand.

-

Shop options This product has multiple variants. The options may be chosen on the product page

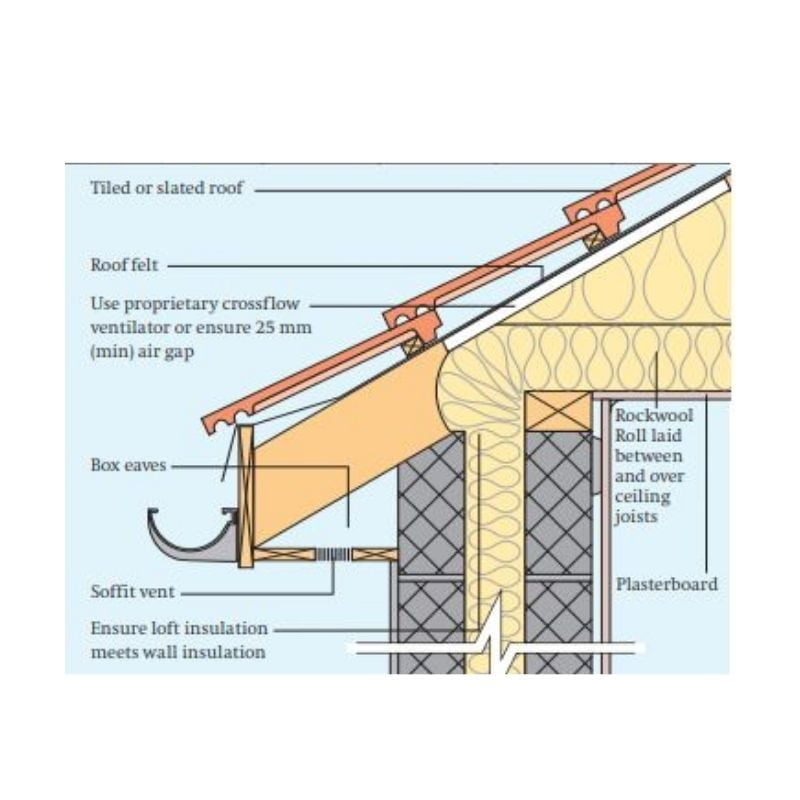

Rockwool Thermal Loft Insulation

Price range: €75.00 through €78.84 (Inc. VAT) -

Shop options This product has multiple variants. The options may be chosen on the product page

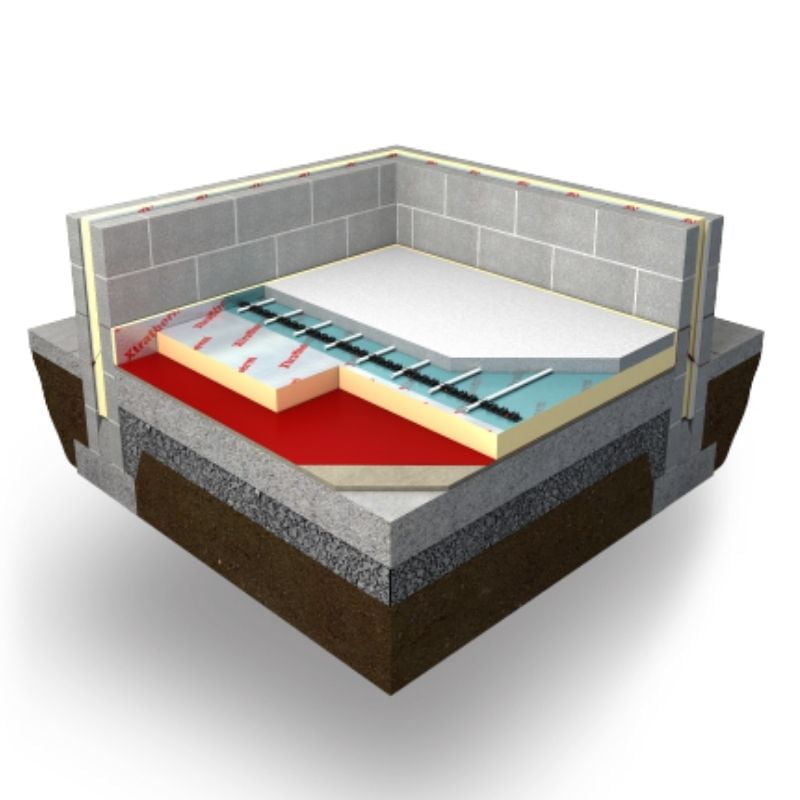

Unilin Floor Insulation Boards / Pitched Roof Insulation boards 2.88m2

Price range: €30.81 through €68.87 (Inc. VAT)

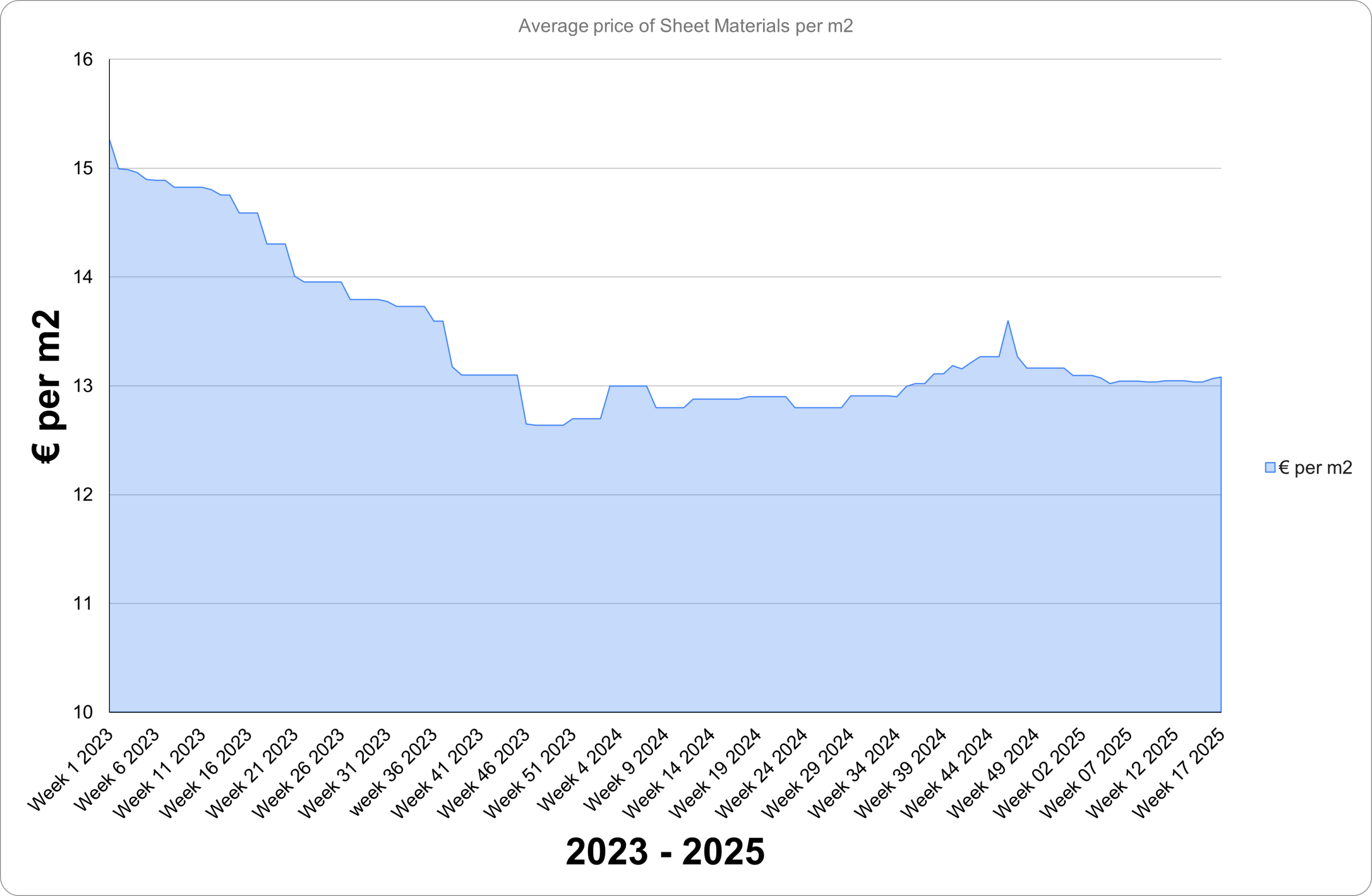

Cost of sheet materials in Ireland

Based on the historical data for sheet material prices per m² from 2023 to mid-April 2025, we can forecast pricing trends for the remainder of Q2 2025 by analysing ongoing patterns and market behaviour.

Price trend overview

Sheet material prices experienced a gradual decline throughout most of 2023, falling from just over €15.26 in January to around €12.64 by November. This decrease reflected market adjustments amid stabilising supply chains and reduced volatility.

By early 2024, prices had rebounded slightly, ranging from €12.7 to €13.3 per m², before entering a period of notable consistency. For much of 2024, prices hovered between €12.8 and €13.2 per m² with minimal fluctuations.

Entering 2025, this stability has continued. Prices have stayed around €13.03 to €13.08 per m² since January, with only very slight week-on-week movement.

Short-term forecast (Q2 2025)

Sheet material prices are projected to remain stable throughout Q2 2025, likely staying in the range of €13.00 to €13.10 per m². While slight weekly adjustments may occur, no major shifts are expected in the absence of unforeseen events. The prevailing pattern suggests confidence in supply, moderated demand, and few cost shocks on the horizon.

Any important developments?

The outlook points towards continued price stability, but key factors such as timber and resin availability, energy costs, and shipping delays should still be monitored. Mild upward movement may emerge in the second half of the year if input costs rise or if construction activity intensifies seasonally. For now, sheet materials remain one of the more stable product categories in the market.

-

Shop options This product has multiple variants. The options may be chosen on the product page

Marine Plywood Sheeting

Price range: €45.50 through €71.50 (Inc. VAT) -

Shop options This product has multiple variants. The options may be chosen on the product page

MDF Sheets

Price range: €27.52 through €53.95 (Inc. VAT)

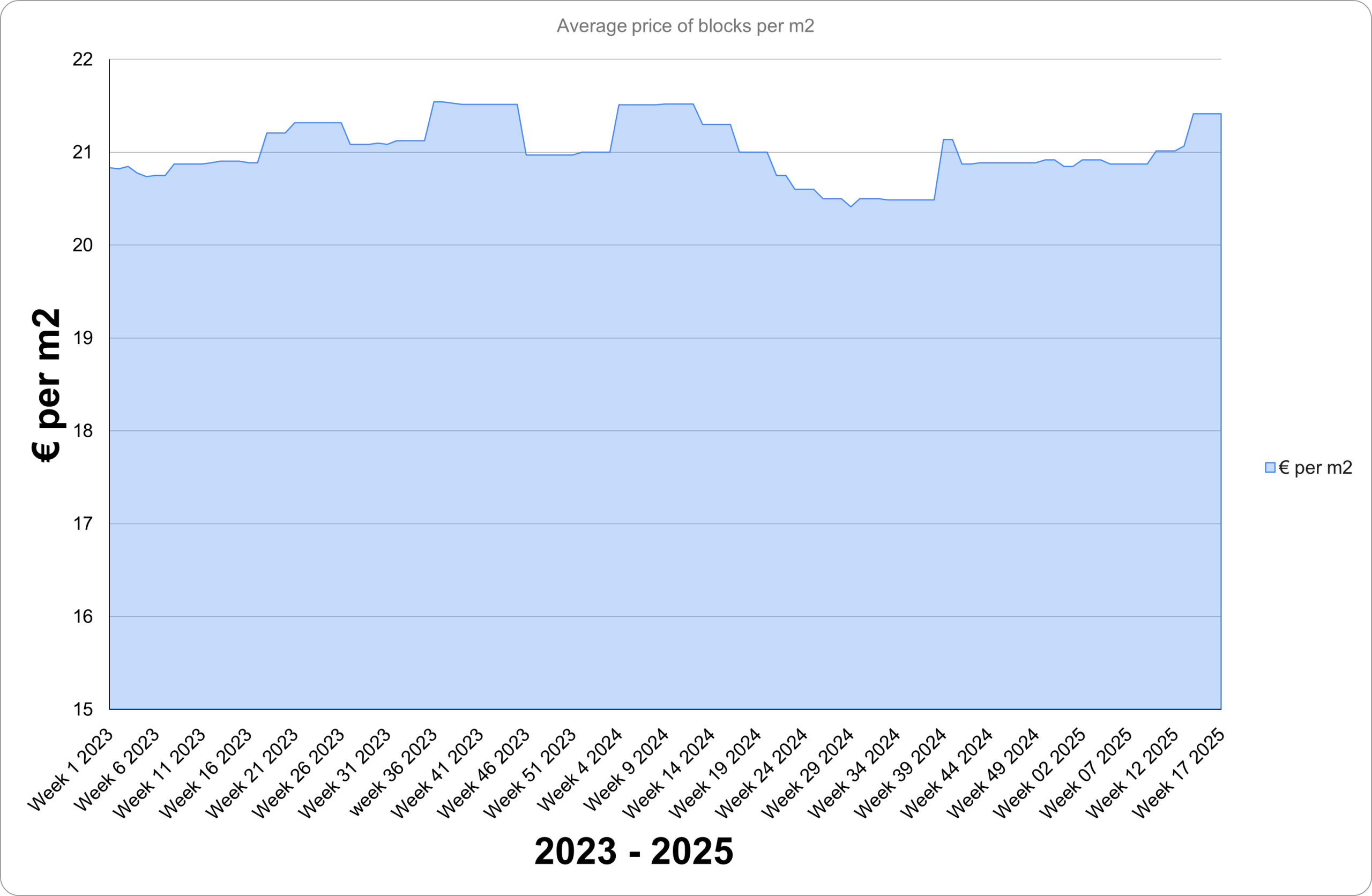

Cost of blocks in Ireland

Based on the historical data for block prices per m² from 2023 to mid-April 2025, we can forecast pricing trends for the remainder of Q2 2025 by analysing the underlying patterns and recent market developments.

Price trend overview

Block prices showed a relatively stable pattern through 2023, fluctuating between €20.75 and €21.51 per m². Prices rose slightly in early 2023 before levelling off mid-year at around €21.31. A small peak followed later in the year before dropping to approximately €20.97 by December.

In 2024, prices ranged from €20.5 to €21.52 per m², with notable volatility mid-year. A dip to €20.41 occurred in late summer before rebounding to over €21.13 by autumn. Prices ended the year near €20.85.

The first few months of 2025 saw continued price stability, starting at €20.85 and rising modestly to €21.41 by mid-April. This upward shift suggests mild market tightening or cost pressure.

Short-term forecast (Q2 2025)

For Q2 2025, block prices are expected to remain broadly stable, with weekly values projected to range between €21.00 and €21.45 per m². The early 2025 price rise is not currently indicative of a longer-term spike, but slight upward movement may persist depending on market inputs and seasonal demand.

Any important developments?

While the market remains steady, minor price increases may continue into the summer. This could reflect rising energy or transport costs, or increased building activity. However, unless there are disruptions in material supply or inflationary shocks, significant volatility is unlikely. Contractors and suppliers should budget with a margin for modest increases but not anticipate major shifts in pricing.

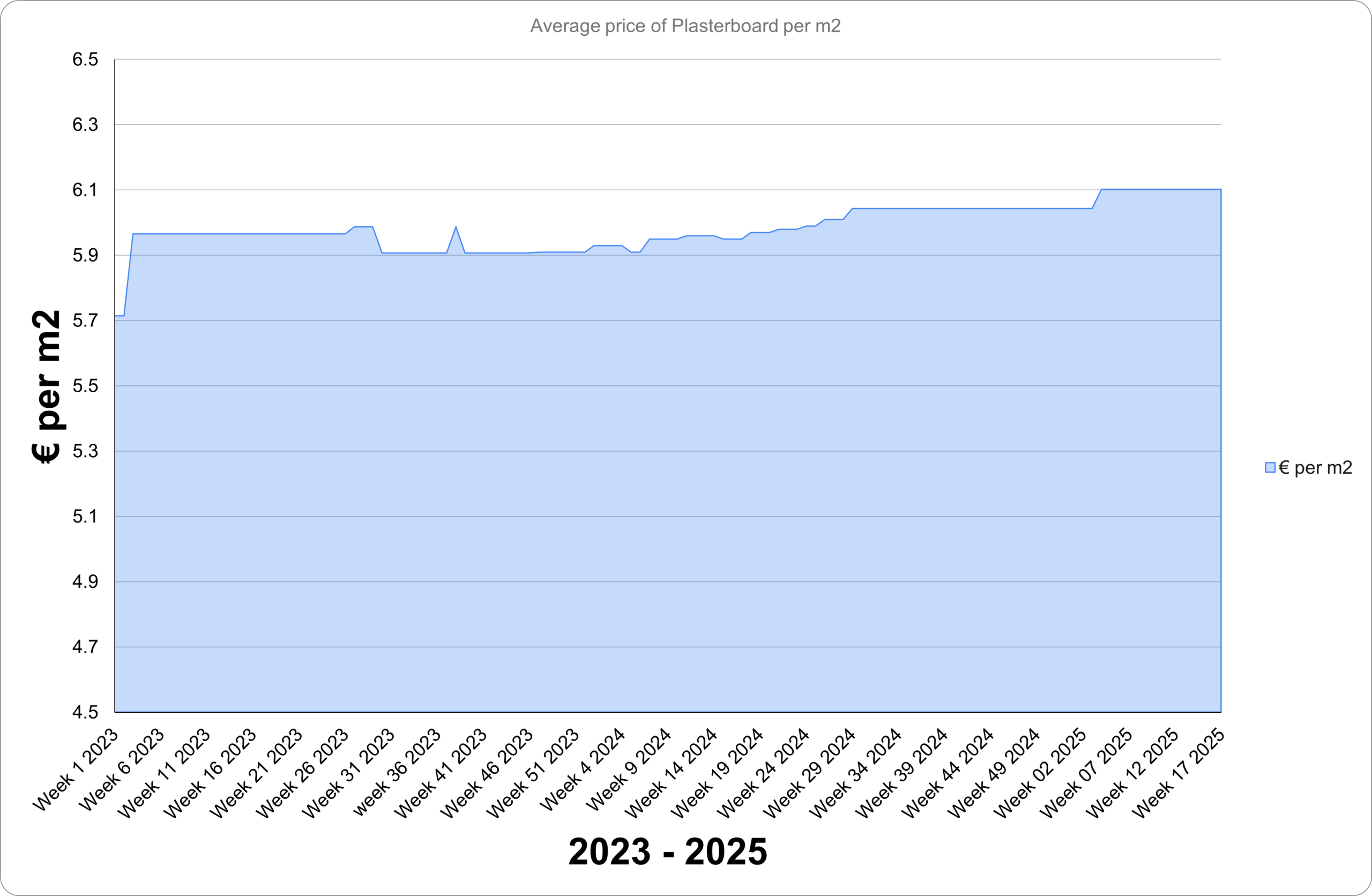

Cost of Plasterboard in Ireland

Based on the historical data for plasterboard prices per m² from 2023 to early 2025, we can forecast the price evolution for the remainder of 2025 by examining the trends and underlying patterns.

Price trend overview:

From the beginning of 2023 through to early 2025, plasterboard prices showed a gradual upward trend with minimal volatility.

In 2023, the price started at €5.71 per m² in Week 1 and remained stable for most of the first half of the year. A gentle upward movement began in Q3, with prices reaching €5.91 by Week 47, where they held steady through the end of the year.

In 2024, the price began at €5.93 per m² and saw small, incremental increases throughout the year. By Week 7, the price had climbed to €5.95 and continued to rise steadily to €6.01 by Week 26. The year ended with prices levelling off at approximately €6.04 per m².

During the first 17 weeks of 2025, plasterboard prices have remained stable, increasing slightly from €6.04 to €6.10 per m²—reflecting low but consistent inflationary pressure.

Short-term forecast (Q2–Q3 2025):

Plasterboard prices are expected to remain stable through mid-2025, fluctuating within a narrow range of €6.10 to €6.15 per m². Absent significant changes in material or energy costs, only minor adjustments are anticipated.

Any important developments?

The market outlook for plasterboard remains steady, supported by a well-established supply chain and consistent demand. While prices may rise modestly in the second half of 2025—potentially reaching €6.20 per m²—such changes are likely to be gradual. Key influencing factors include gypsum availability, energy costs, and transport rates. Without major external shocks, price volatility remains unlikely.

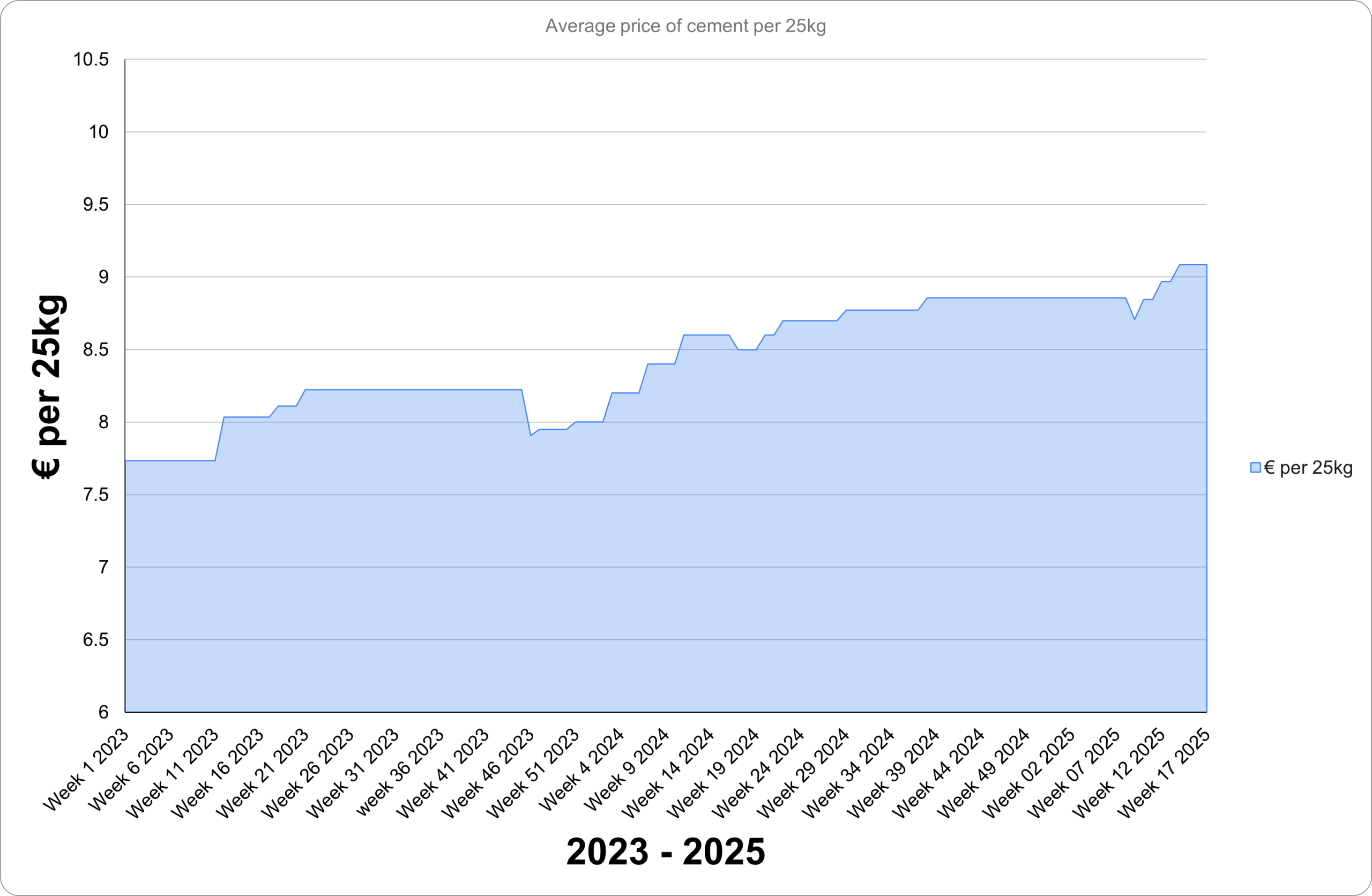

Cost of Cement in Ireland

Based on the historical data for cement prices from 2023 to early 2025, we can forecast the price evolution for the remainder of 2025 by examining the trends and underlying patterns.

Price trend overview:

From early 2023 through to early 2025, cement prices have followed a clear upward trajectory, largely driven by gradual cost increases and seasonal demand patterns.

In 2023, prices remained stable at €7.73 per unit through the first 11 weeks. A steady rise followed, with prices reaching €8.22 by mid-year. A temporary dip occurred in Week 46 to €7.91, but prices recovered quickly, ending the year at €8.00.

In 2024, cement prices continued to rise. Beginning at €8.00, the price reached €8.60 by the end of Q1 and climbed to €8.87 by Week 38. Prices then plateaued at this level through the remainder of the year.

In early 2025, prices held steady at €8.8575 before increasing modestly to €9.085 by Week 14—indicating renewed upward momentum.

Short-term forecast (Q2–Q3 2025):

Cement prices are expected to remain within the €9.05 to €9.15 range over the next two quarters. Moderate increases may occur as seasonal construction activity ramps up and if energy or transport costs rise.

Any important developments?

The outlook for cement pricing in 2025 remains stable with gradual upward pressure. Sustained construction demand continues to support pricing. However, key risks such as fuel cost fluctuations, carbon pricing policies, and potential supply disruptions could accelerate price increases. Barring major shifts, prices may rise modestly toward €9.20–€9.30 by year-end, with sharp hikes remaining unlikely.

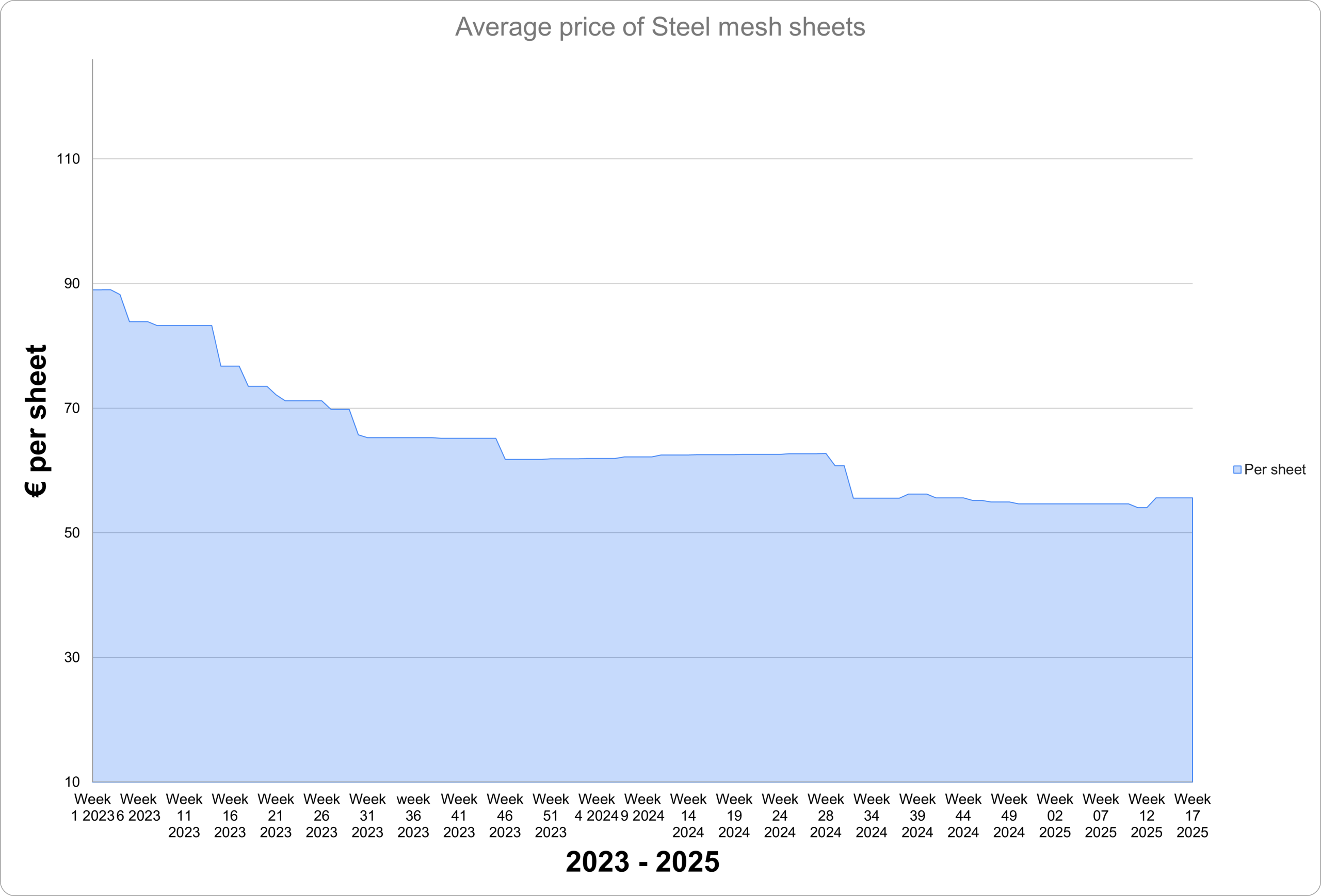

Cost of Steel in Ireland

Based on the historical data for steel mesh sheet prices from 2023 to early 2025, we can forecast the price evolution for the remainder of 2025 by examining the trends and underlying patterns.

Price trend overview:

From the start of 2023 through early 2025, steel mesh sheet prices experienced a steady decline followed by signs of stabilisation and a slight rebound.

In early 2023, prices were high at approximately €88.99 per sheet in Week 1. A sharp drop occurred by Week 15, bringing prices down to €76.76. This downward trend continued through the summer, with prices reaching €65 by Week 30 and further declining to €61.90 by the end of the year.

In 2024, a mild recovery was observed early in the year, with prices gradually rising to €62.70 by Week 28. However, this was followed by a renewed drop, reaching approximately €54.65 by Week 50 and holding that level through the end of the year.

In 2025, prices remained flat at €54.65 through Week 10, dipped slightly in Weeks 11–12, and then rebounded to €55.59 by Week 13. Prices have remained stable at this level since.

Short-term forecast (Q2–Q3 2025):

Steel mesh sheet prices are expected to remain relatively stable through mid-year, hovering in the €55–€56 range. As construction activity increases in warmer months, modest gains may occur, though major fluctuations are unlikely unless raw material costs change significantly.

Any important developments?

The recent rebound in Week 13 may signal the end of the prolonged price decline, suggesting a potential stabilisation phase. Steel input costs remain steady, providing a foundation for current pricing. Looking ahead to the second half of 2025, prices could rise slightly toward €56–€57 if demand strengthens, but significant increases are not anticipated without broader market shifts.

My Build Club

Calling all Trades Professionals, Self Builders, Renovators and DIY lovers!

We have created an entirely unique section of our website that has been designed to make your life easier.

Enjoy discounts, get an even more enhanced level of customer service, find all your paperwork easily and get unique offers and deals regularly.

My Build Club is a brand new innovative service for all Self Builders, Renovators, Trade Professionals and DIY lovers in Ireland.

We have revolutionised how you can source the right products at the very best prices along with putting you in touch with real life experts to help you every step of the way.

Why join today?

- Save money and time when sourcing the supplies you need

- Get Trade discounts just like you would at our Trade Counter

- On demand support from our experts – video calls, live chat and phone support

- All of your paperwork and invoices in the one place

- Arrange fast delivery – including to work sites